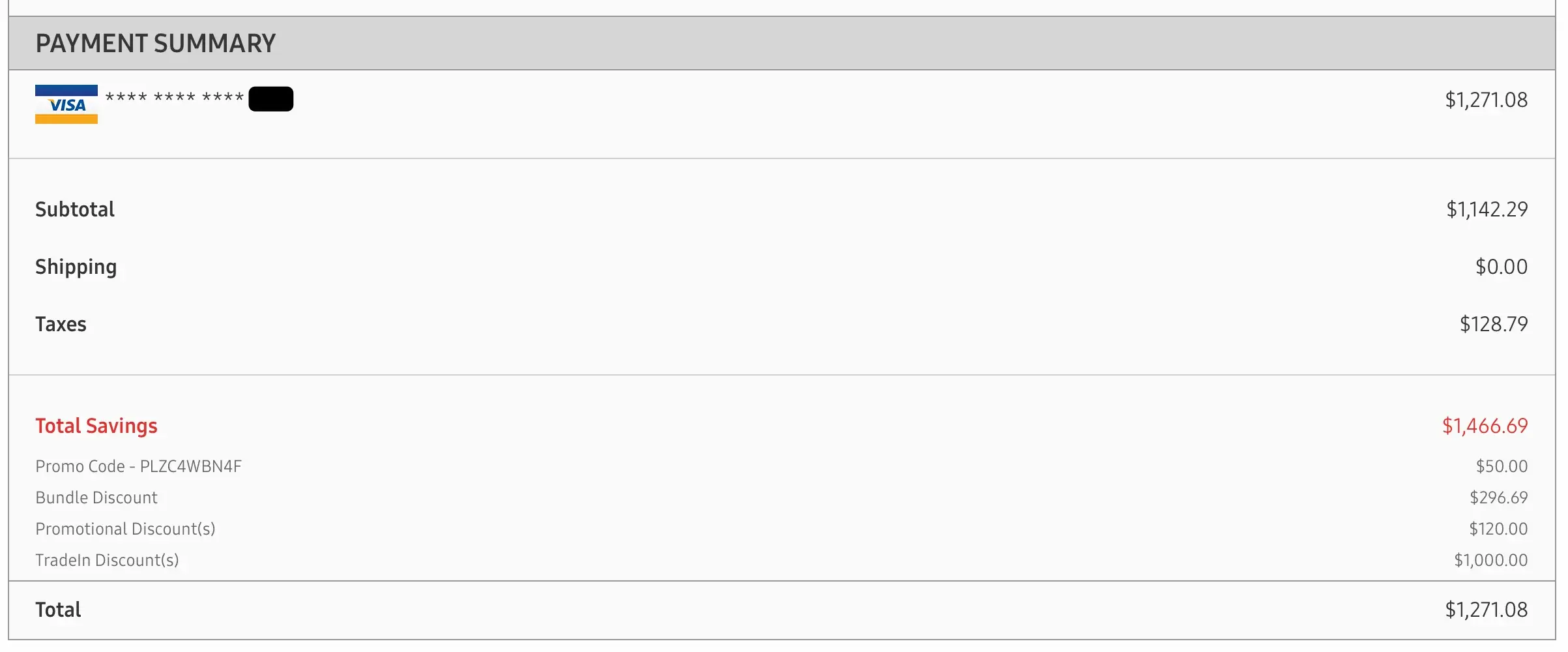

It is being shipped. I'm not sure where the origin is, but if they're in an origin based state then I'd expect it to be the same 11.275% for everyone. Afaik CA is the only hybrid one where state, county, city are origin based and district is destination based. I don't think any of my 10.25% is a district rate, so even it that case it should effectively be the origin rate if I understand how this works correctly (which I probably don't because sales tax is really a nightmare)

sargunv

joined 1 year ago

I saw the rule but thought it’s helpful for the community as if they’re overcharging me, they’re probably overcharging other people, and folks should check their invoice!

Happy to have it moved or reposted if y’all disagree though

imgur album of support convo: https://imgur.com/a/bdAaot7

tldr: they didn't have an immediate answer, they say they'll follow up by email in 2 business days 🤷

it's complicated 🙃 (see the bit about remote sellers)