this post was submitted on 27 Jul 2023

9 points (90.9% liked)

Ask Android

2196 readers

7 users here now

A place to ask your questions and seek help related to your Android device and the Android ecosystem.

Whether you're looking for app recommendations, phone buying advice, or want to explore rooting and tutorials, this is the place for you!

Rules

- Be descriptive: Help us help you by providing as many details as you can.

- Be patient: You're getting free help from Internet strangers, so you may have to wait for an answer.

- Be helpful: If someone asks you for more information, tell us what you can. If someone asks you for a screenshot, please provide one!

- Be nice: Treat others with respect, even if you don't agree with their advice. Accordingly, you should expect others to be nice to you as well. Report intentionally rude answers.

- No piracy: Sharing or discussing pirated content is strictly prohibited. Do not ask others for a paid app or about how to acquire one.

- No affiliate/marketing links: Posting affiliate links is not allowed.

- No URL shorteners: These can hide the true location of the page and lead people to malicious places.

- No lockscreen bypasses: Please do not comment, link, or assist with bypassing lock screens or factory reset protection.

- No cross-posting: Please take the time to make a proper post instead of cross-posting.

Other Communities

- !android@lemdro.id

- !androidmemes@lemdro.id

- !google@lemdro.id

- !googlepixel@lemdro.id

- !xiaomi@lemdro.id

- !sony@lemdro.id

- !samsung@lemdro.id

- !galaxywatch@lemdro.id

- !oneplus@lemdro.id

- !motorola@lemdro.id

- !meta@lemdro.id

- !apple@lemdro.id

- !microsoft@lemdro.id

- !chatgpt@lemdro.id

- !bing@lemdro.id

- !reddit@lemdro.id

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

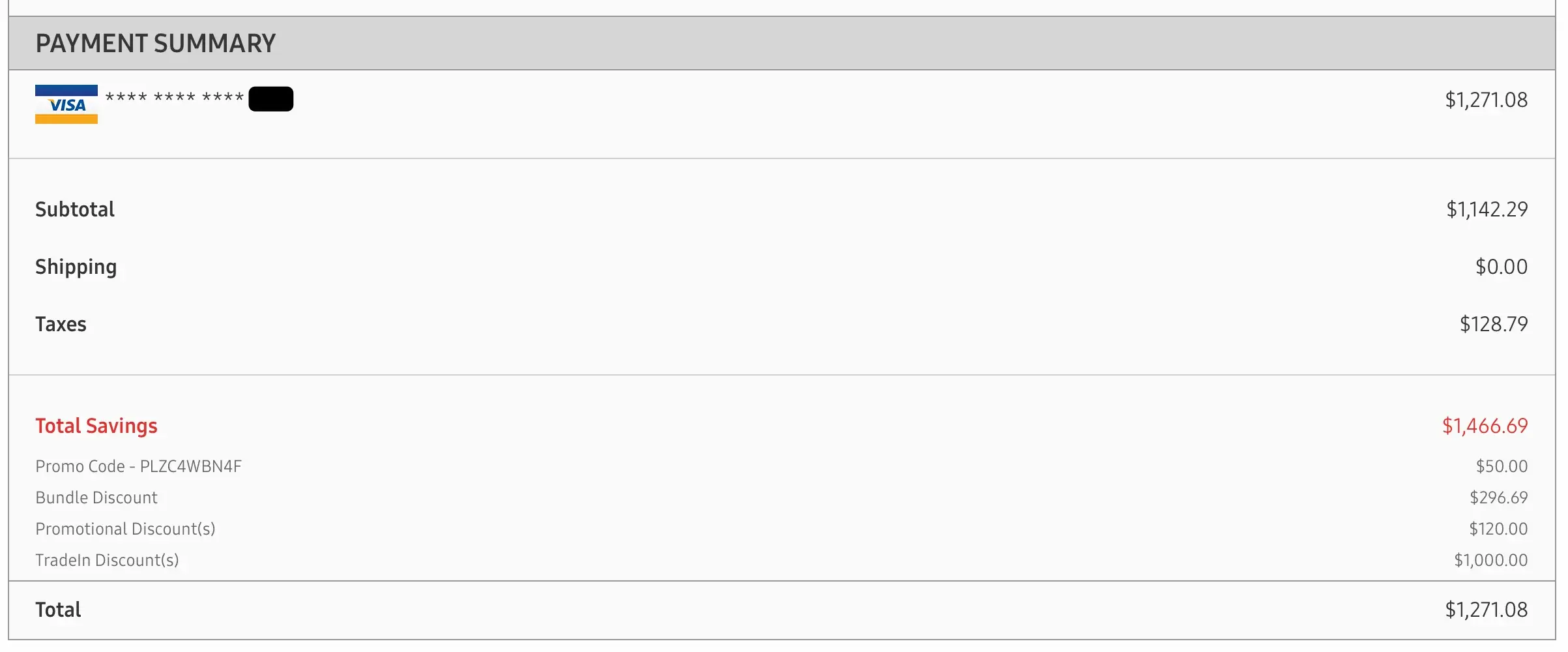

Is it being shipped? Some jurisdictions require sales tax in the origin and destination.

Also sales tax is a nightmare 😭

It is being shipped. I'm not sure where the origin is, but if they're in an origin based state then I'd expect it to be the same 11.275% for everyone. Afaik CA is the only hybrid one where state, county, city are origin based and district is destination based. I don't think any of my 10.25% is a district rate, so even it that case it should effectively be the origin rate if I understand how this works correctly (which I probably don't because sales tax is really a nightmare)

Is it based on the originating warehouse location or the corporate HQ? I know Samsung ships things from multiple locations here in Canada (but our sales taxes are based on where the customer is).

it's complicated 🙃 (see the bit about remote sellers)

That definitely seems unnecessarily complicated!