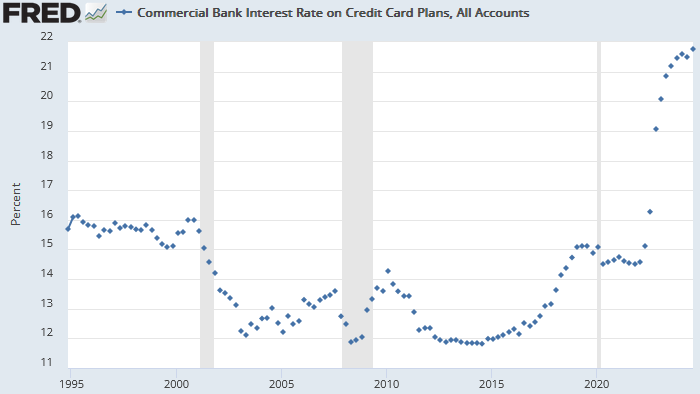

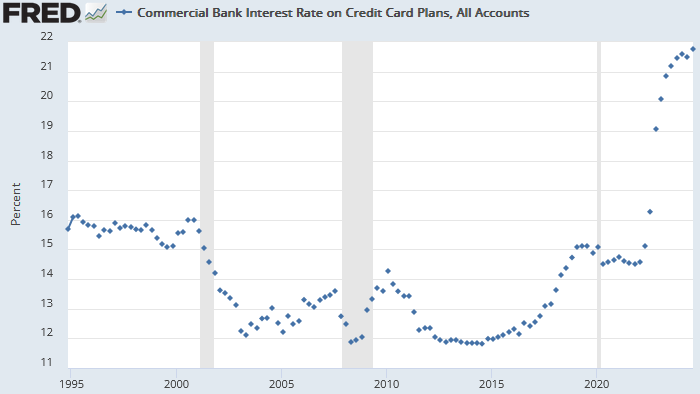

Which is especially worrying considering the interest rate:

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

Which is especially worrying considering the interest rate:

Those rates are nothing short of preditory. I'm also going to guess the average consumer doesn't "shop" for credit cards.

If you're going to run a credit card balance, which you typically shouldn't, you might as well make sure it's costing you as little as possible.

Fixed rate cards and cards from regional banks or credit unions will often offer lower rates.

It's so crazy to have credit cards, we call them that here in the EU too but there is usually not much "credit" on them and you're supposed to be on the plus side... What a wild idea.

We call that a debit card

Credit cards in the US are extremely easy to get and easy to fall into inescapable debt with. I went to a hardware store and signed up for one so I could get 0% financing on some appliances over a year. I asked for like a $2k card. I told them I made $30k a year and they gave me a card with a limit of $8k about 2 minutes later. Now my finances were never even checked, just my credit score. I could have easily lied and said I made way more to get a higher limit, because I actually did lie and said I make less so they wouldn't give me such a high credit limit. It would be very easy for me to get a higher credit than I have income I think.

It almost sounds like you’re describing a charge card instead of a credit card. American Express offers those in the US, but it’s not nearly as widespread in usage as a standard bank credit card.

Can you explain what you mean by being on the plus side? You're supposed to have a balance on a credit card, like it's a debit card?

My credit cards I've had in Germany/Austria were all basically glorified debit-cards which had their own bank account attached to them. Technically I had a credit limit of a couple thousand, but I never went into the negative.

The only difference (for me at least) was that I could use them to rent a car, which is nice.

Youre supposed to not be in debt, even if you're allowed, that's like the general consensus.

So are americans just not understanding credit cards or do they just not care?

I commented once about what a ripoff credit cards are and how they haven't really taken off in other countries because they're basically a scam.

I got verbally attacked by people telling me how great they are because they give you cashback

They genuinely thought the credit card company was giving them free money lmao

Basically the financial wherewithal of Liz fucking Truss

It’s a system designed to prey on vulnerable people. The world would be much better off without these cards.

A lot of people don't understand them. Others don't care, thinking they will deal with the debt later or never.

American basic education in math doesn't really cover financial math much.

But how does it work, then?

You use the money you put in your bank account and that's it.

That is a debit card, not a credit card. We also have debit cards in the US.

The way it works here is you can use a normal bank card to pay directly of your checkings account balance, meaning if you have insufficient funds, the card gets declined. A credit (debit) card allows you to pay regardless of you checkings balance. But at the end of the month your negative credit balance must be covered by your checkings account. If it doesn't cover the whole sum, the debt interest kicks in. A true credit card is essentially the same, but instead of automatically balancing the credit, you have to manually transfer the money to the bank. The advantage being that you can use 2 different banks for credit and checking accounts.

You can say 40%. The numerically literate, non-credit-card owners will understand