this post was submitted on 16 Nov 2024

633 points (98.8% liked)

Microblog Memes

5777 readers

2028 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

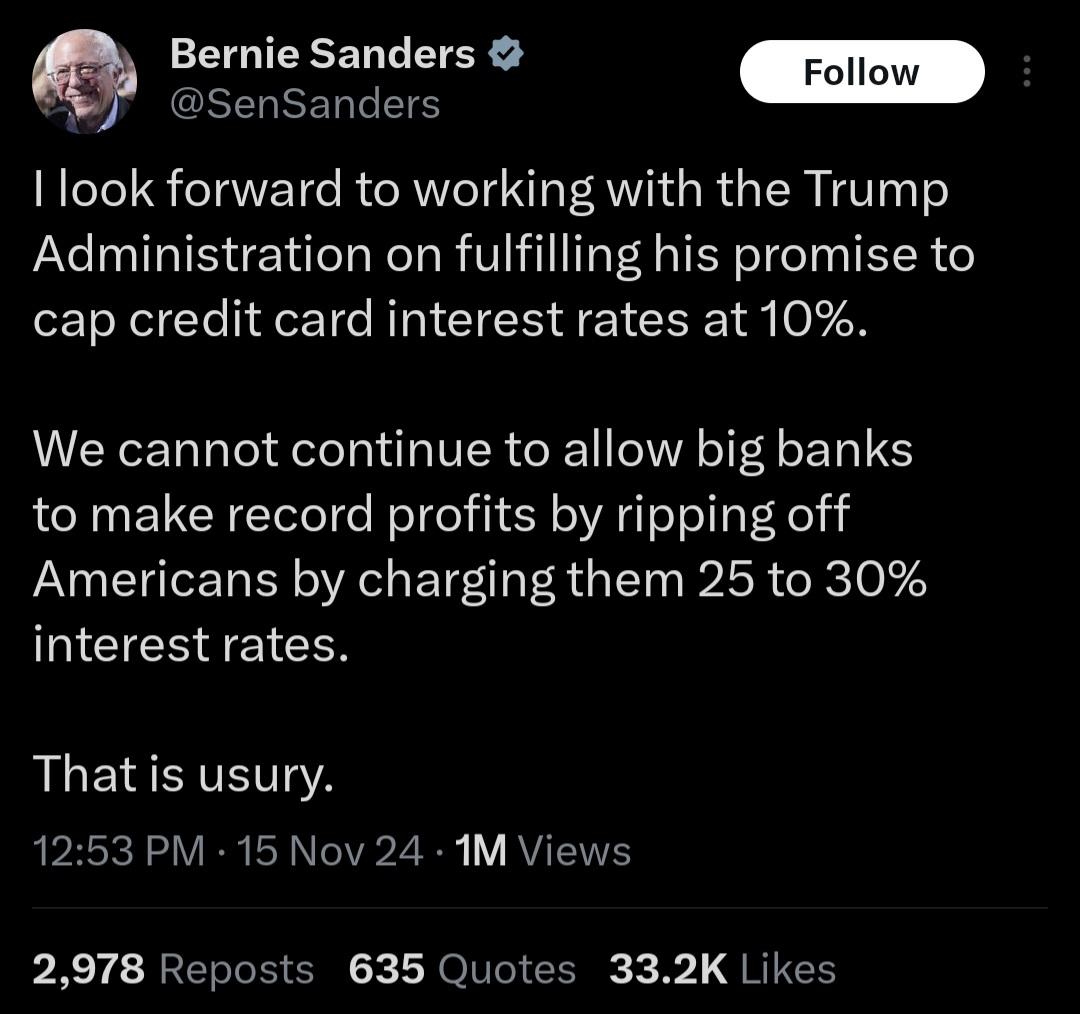

What that would actually mean is a complete lock-out on credit cards for the poor.

I don't see that as a real problem. Because as it is now, credit cards are something poor people should avoid at all costs.

No, it's a thing idiots should avoid at all costs.

A card with a 2% reward across the board(Fidelity for instance) can be used as a proxy for your debit card week to week.

It builds my credit, gives me a group of attack dogs to sic on anyone who rips me off, and gives me a cushion if I ever need it. If you never exceed your expenses and never reach beyond your means, it's no different in consequence than paying with anything else, with a little added bonus credit and reward.

It's people and their lack of self control that ruin credit cards.

Oh God, who will the Credit Card companies exploit?!

Actually asking, not rhetorical: if poor people are already getting charged based on what they can afford, would this policy exert a downward force on prices?

So way less financing options, slightly more buying outright?

Problem is the assumption that prices would go down if some people cannot afford it.

Whats happening instead is people going hungry and homeless.

The reason for this is that Supply:Demand Equilibrium is further up in price range where fewer sales at higher value yields the maximum profit.

Considering how many Americans have crippling credit card debt, especially poor people, would that be worse? I'm sure they'd still offer those credit builder cards with low limits that you have to deposit collateral for the limit.

I'd expect a lot more use of buy now pay later schemes like Klarna.

It's similar to a credit card, but prevents build up of crippling debt.

I personally use my credit card and pay in full each month, not because I need the credit, but because in the UK you get the benefit of Section 75 protection on purchases. I've used that a few times when companies have gone bust. If I'd paid on debit card I'd have been screwed.

Buy now, pay later does not prevent crippling debt. It makes it easy to buy without thinking or realising the actual cost. It makes is easy to stack up invoices that you in the end can't afford.

Don’t Americans have a thing called Credit Score. If you are not paying off debt you don’t build up a score and good luck getting a mortgage without one.

It's a combination of factors. Having debt itself isn't as important as payment history, age of accounts, etc. Credit card debt is probably the opposite of helpful; paying off a card every month in full for a long time is much more useful.

Sure, if we presuppose that credit cards exist as a way for a middleman company to make a huge profit and pay their CEO tens of millions of dollars annually. If we instead consider them a regulatable utility, the necessary rates for viable operation go pretty far down. The business model of “convenience is free or even costs less than cash for those who already have plenty, and this convenience is funded by the destitute who are being held down by the exact same people” is also suspect to begin with, and I’d rather DiSrUpT tHe EcOnOmY than remain complicit, which I am