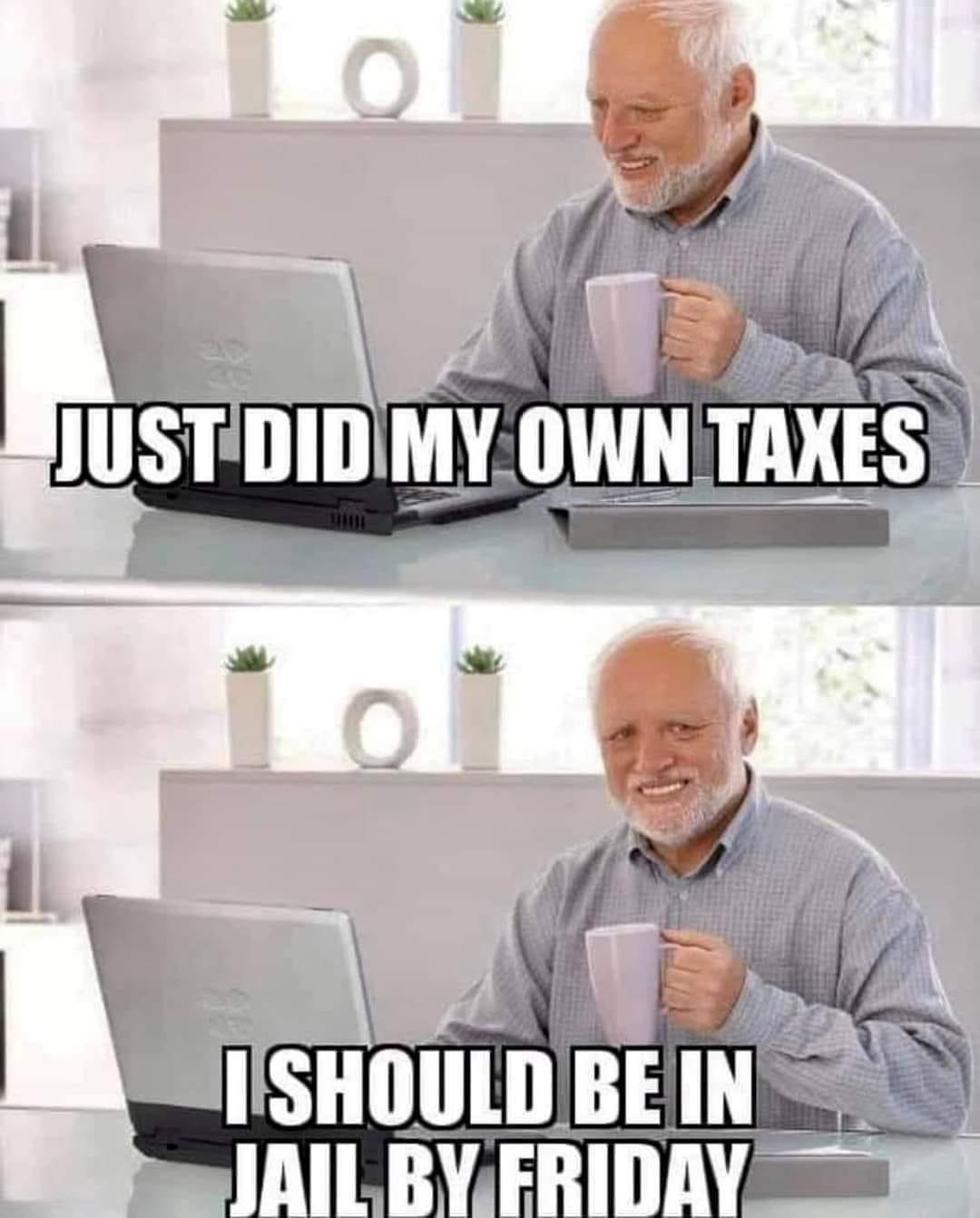

I may be too European to understand this

Funny

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

In some countries, rather than sending you a bill, the government calculates what you owe and then refuses to tell you. You are then responsible for working out the same solution they did and then paying them (note that both steps are hard, and the government may refuae payment without explanation).

If you successfully pay them and the payment was too low, they may come after you, typically with fines, but if you fucked up badly enough, potentially even jail time. Same thing if you did not succeed in paying them at all, because that will count as failure to file even though it's their fault.

If you overpay, the government chuckles and pockets the difference.

So accurate it hurts. There is so much we have yet to fix. This weird tax game has gotta go.

What the heck

It's really just a meme anyway. I'm American and do my own taxes. It's labyrinthine, but not actually that hard honestly.

The place where individuals get themselves in trouble with the government is the more subtle business related stuff like writing off expenses, carrying forward business losses, depreciating assets, selling stock. That stuff is probably best left to an accountant.

But as a regular person filing with mortgage deduction, college tuition deduction, child tax credits, if you make a mistake the most likely response is just gonna be a letter telling you to try again.

Me too

Even better is taxes would be late as they're due in April (unless you file for an extension).

Australian. It's the fine line between claiming enough to not get audited and getting an involuntary tax office enema.

I can definitely relate to this. When I was young and my taxes were dead simple I didn't think twice, now that I'm older and my tax situation is more complex I always fear that I've done something wrong no matter how many times I double check.

I may start paying someone just to avoid the anxiety but I probably won't because I'm too cheap.

Tax Software propaganda smh

The tin foil hat is coming loose, mate.

IIRC the tax software companies share data all the time. If they don't, it opens them up as high targets for attackers and they get data breached.

Only if you fudged them knowingly. If you're just stupid then you probably won't get arrested.

Did my taxes for years like this. Had a particularly challenging year and hired an accountant who literally played the guessing game in front of me - "if we don't know the answer to x then we'll just put y." He also told me that no guarantees but the IRS doesn’t really go after small irregularities on taxes. Guess that advice and hiding behind his CPA shield was worth the money?

Also fuck TurboTax. Use FreeTaxUSA! And remember, you can use TurboTax or another satanspawn tax prep software to get your numbers about right, then file for free with FreeTaxUSA.

I did my taxes this year and now I am not sure if they were done fine or not ugh !