this post was submitted on 10 Aug 2023

342 points (96.7% liked)

Funny

6828 readers

453 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

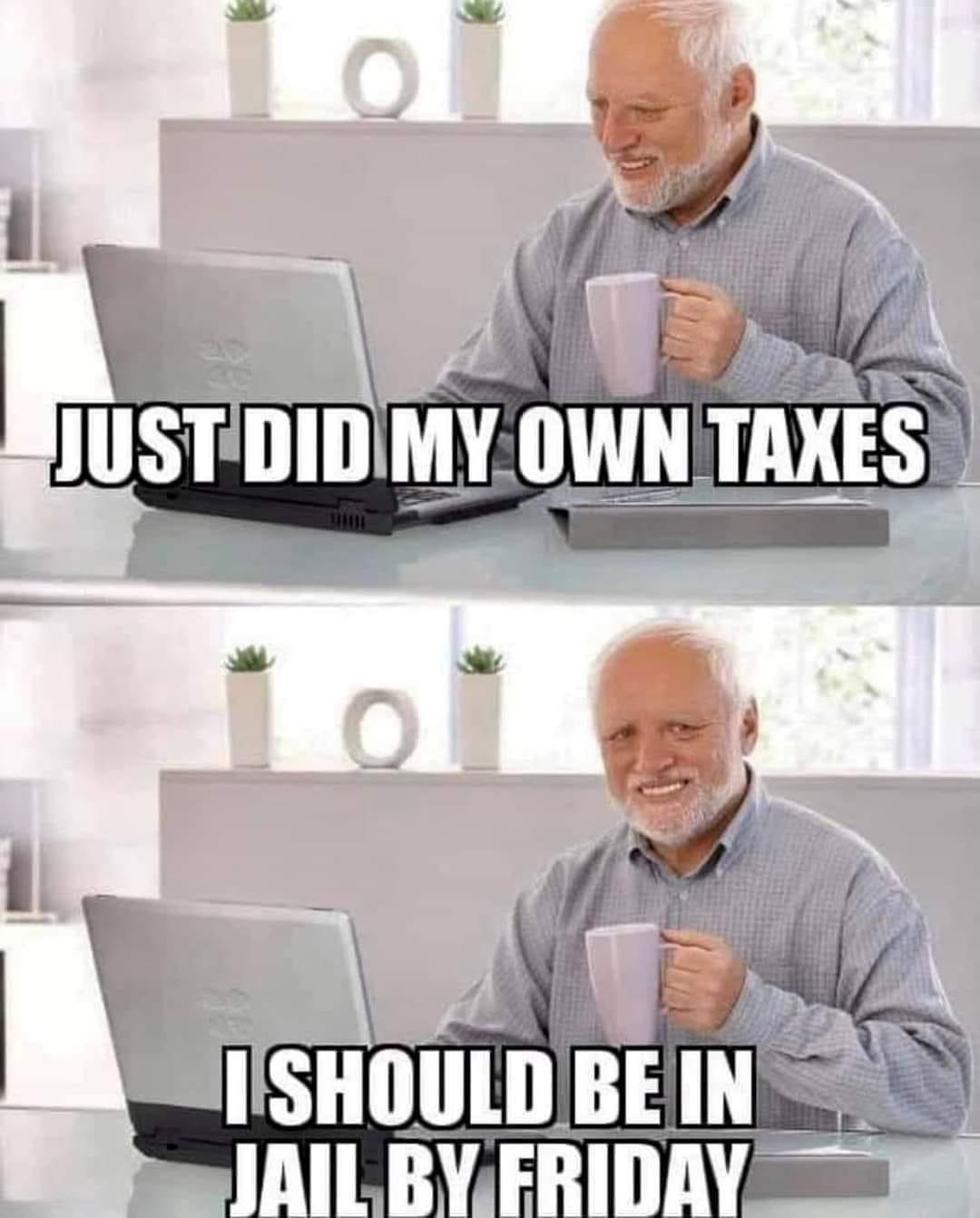

I may be too European to understand this

In some countries, rather than sending you a bill, the government calculates what you owe and then refuses to tell you. You are then responsible for working out the same solution they did and then paying them (note that both steps are hard, and the government may refuae payment without explanation).

If you successfully pay them and the payment was too low, they may come after you, typically with fines, but if you fucked up badly enough, potentially even jail time. Same thing if you did not succeed in paying them at all, because that will count as failure to file even though it's their fault.

If you overpay, the government chuckles and pockets the difference.

So accurate it hurts. There is so much we have yet to fix. This weird tax game has gotta go.

What the heck

It's really just a meme anyway. I'm American and do my own taxes. It's labyrinthine, but not actually that hard honestly.

The place where individuals get themselves in trouble with the government is the more subtle business related stuff like writing off expenses, carrying forward business losses, depreciating assets, selling stock. That stuff is probably best left to an accountant.

But as a regular person filing with mortgage deduction, college tuition deduction, child tax credits, if you make a mistake the most likely response is just gonna be a letter telling you to try again.

Me too

Australian. It's the fine line between claiming enough to not get audited and getting an involuntary tax office enema.

Even better is taxes would be late as they're due in April (unless you file for an extension).