Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

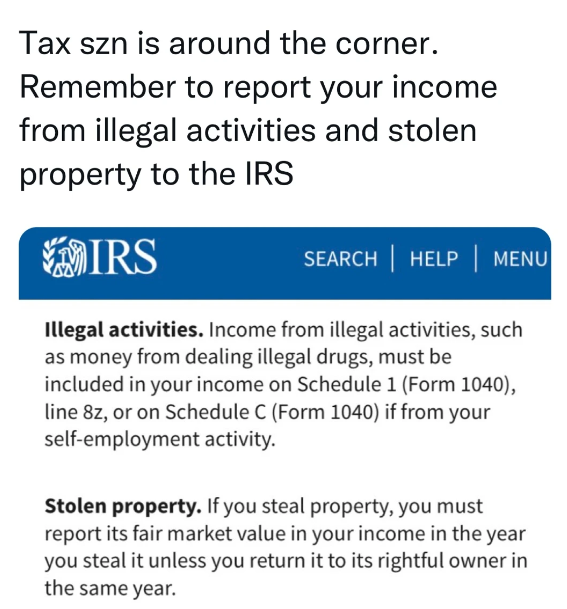

Line 8z is "all other types of income" it's not specifically "income from crimes."

It's just a catch all for anything not covered in A through P. Like, gambling winnings or unreported cash tips. The IRS just wants their cut. They don't actually care where the money comes from. An insurance payout might go on that line.

They're already getting their cut from sales tax after an insurance payout. That ain't income. Do I get to also declare a loss on anything lost, stolen, or depreciating in value?

Edit: downvotes from people overpaying the IRS, or who've never had to make an insurance claim

Literally yes. In fact about half of the lines 8 are to report losses.

Income is any income, you pay a sales tax when you buy goods, the merchant pays income tax on those same dollars. Or they would if somehow during a record profit year they actually made no money.

No. Insurance payouts are not overall taxable. You also cannot claim depreciation on your personal vehicle, and if you lose property, the IRS doesn't give a shit.

Certain insurance payouts, specifically those that exceed your premiums, are taxable. Lump sum payments generally aren't unless it's a benefit provided by your employer in excess of 50k, but annuities are taxable. As would be any interest you collect on those policies.

Depreciation on a vehicle you use to generate income is deductable, as would be say, depreciation on a home you rent out. And if you rent out rooms in your personal home but don't run a business renting out property, that income needs to be reported too.

This discussion has only been about personal taxes, so stop bringing up business taxation.

Are you talking solely about life insurance? Because that is one very specific thing, and payouts from that are not in the same category at all as any other typical insurance.

Which is why there's a line for other undeclared income.

The whole conversation is about line 8 not exclusively being for crimes.