this post was submitted on 15 Apr 2024

720 points (98.0% liked)

Funny

6818 readers

772 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

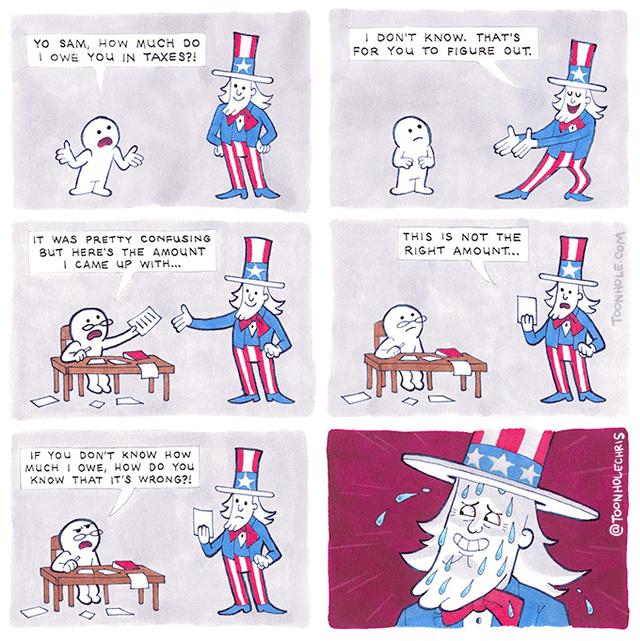

pan to tax preparation companies taking turns sucking off Uncle Sam

My son made a mistake on his state taxes and his return was rejected. The letter he got back basically said "we couldn't verify your reported property taxes, so you can resubmit a correction or do nothing and accept our version of your taxes" (where he gets back about $200 less because of a typo.)

So, like, yeah. They're just comparing your notes to theirs, with the default benefiting the state.

Seems like the property taxes would be the easiest thing in the world for them to verify. Unless they've been lying to themselves.

I believe they had a typo entering their PIN. The property number is like 15 digits long with multiple hyphens. It was fine last year, but this year they got "wE cAn'T vErIfY yOuR pRoPeRtY tAxeS" .🙄